Allianz published its risk barometer for 2022, noting that cyber perils outrank Covid-19 and broken supply chains as top global business risk.

According to the report, cyber perils are the biggest concern for companies globally in 2022, as the threat of ransomware attacks, data breaches or major IT outages worries companies even more than business and supply chain disruption, natural disasters or the Covid-19 pandemic.

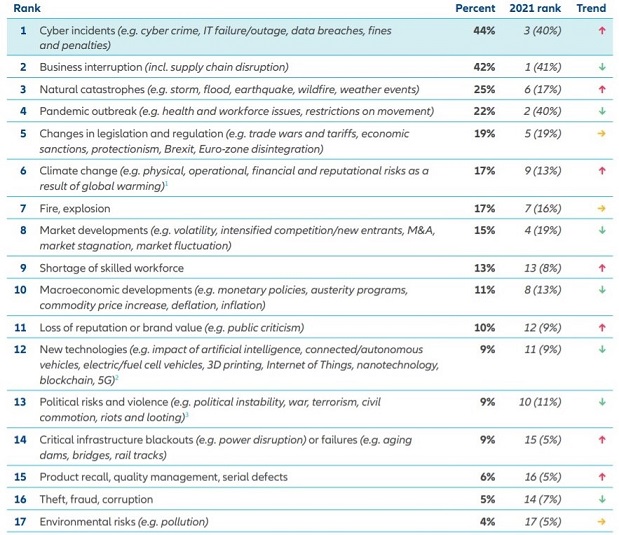

In fact, cyber incidents tops the Allianz Risk Barometer for only the second time in the survey’s history (44% of responses), with Business interruption dropping to a close second (42%) and Natural catastrophes ranking third (25%), up from sixth in 2021.

Moreover, climate change rose to its highest-ever ranking of sixth (17%, up from ninth), while Pandemic outbreak drops to fourth (22%).

"Crippling cyber-attacks, the supply chain impact from many climate change-related weather events, as well as pandemic-related manufacturing problems and transport bottlenecks wreaked havoc. This year only promises a gradual easing of the situation", stated Joachim Müller, CEO of AGCS.

Ransomware drives cyber concerns

Cyber incidents ranks as a top three peril in most countries surveyed, and the main driver is the recent increase in ransomware attacks, which are confirmed as the top cyber threat for the year ahead by survey respondents (57%).

Namely, attacks have shown worrying trends such as ‘double extortion’ tactics combining the encryption of systems with data breaches; exploiting software vulnerabilities which potentially affect thousands of companies or targeting physical critical infrastructure.

Cyber security also ranks as companies’ major environmental social governance (ESG) concern with respondents acknowledging the need to build resilience and plan for future outages or face the growing consequences from regulators, investors and other stakeholders.

As Scott Sayce, Global Head of Cyber at AGCS, explains, “the commercialization of cyber crime makes it easier to exploit vulnerabilities on a massive scale. We will see more attacks against technology supply chains and critical infrastructure.”

On the other hand, business interruption (BI) ranks as the second most concerning risk. According to the survey, the most feared cause of BI is cyber incidents, reflecting the rise in ransomware attacks but also the impact of companies’ growing reliance on digitalization and the shift to remote working.

Natural catastrophes and pandemic are the two other important triggers for BI in the view of respondents.

In the past year post-lockdown surges in demand have combined with disruption to production and logistics, as Covid-19 outbreaks in Asia closed factories and caused record congestion levels in container shipping ports.

Now, pandemic-related delays affected other supply chain issues, like the Suez Canal blockage or the global shortage of semiconductors after plant closures in Taiwan, Japan and Texas from weather events and fires.

"The pandemic has exposed the extent of interconnectivity in modern supply chains and how multiple unrelated events can come together to create widespread disruption. For the first time the resilience of supply chains has been tested to breaking point on a global scale", highlights Philip Beblo, Property Industry Lead, Technology, Media and Telecoms, at AGCS.

According to the recent Euler Hermes Global Trade Report, the Covid-19 pandemic will likely drive high levels of supply chain disruption into the second half of 2022, although mismatches in global demand and supply and container shipping capacity are eventually predicted to ease, assuming no further unexpected developments.

Pandemic preparations improve

While pandemic outbreak remains a major concern for companies, it dropped from second to fourth position. The Covid-19 crisis still overshadows the economic outlook in many industries, but businesses feel they have adapted well.

More specifically, the majority of respondents (80%) think they are enough or well-prepared for a future incident.

In addition, the rise of Natural catastrophes and Climate change to third and sixth position respectively is revealing. Allianz says that recent years have shown the frequency and severity of weather events are increasing due to global warming.

Moreover, Allianz Risk Barometer respondents are most concerned about climate-change related weather events causing damage to corporate property (57%), followed by BI and supply chain impact (41%).

Nevertheless, they are also worried about managing the transition of their businesses to a low-carbon economy (36%), fulfilling complex regulation and reporting requirements and avoiding potential litigation risks for not adequately taking action to address climate change (34%).

"There is a clear trend for companies towards reducing greenhouse gas emissions in operations or exploring business opportunities for climate-friendly technologies and sustainable products", mentions Line Hestvik, Chief Sustainability Officer at Allianz SE.

Shortage of skilled workforce

Shortage of skilled workforce (13%) is a new entry in the top 10 risks at number nine. Attracting and retaining workers has rarely been more challenging. Respondents rank this as a top five risk in the engineering, construction, real estate, public service and healthcare sectors, and as the top risk for transportation.

In fact, the most recent Seafarer Workforce Report from BIMCO and the International Chamber of Shipping warns that the industry must significantly increase training and recruitment levels, in order to avoid a serious shortage in the total supply of officers by 2026.

Given the growing demand for STCW certified officers, the report predicts that there will be a need for an additional 89,510 officers by 2026 to operate the world merchant fleet.

The report also estimates that 1.89 million seafarers currently serve the world merchant fleet, operating over 74,000 vessels around the globe.

Changes in legislation and regulation

Changes in legislation and regulation remains fifth (19%). Prominent regulatory initiatives on companies’ radars in 2022 include anti-competitive practices targeting big tech, as well as sustainability initiatives with the EU taxonomy scheme.

Fire and explosion

Fire and explosion (17%) is a perennial risk for companies, ranking seventh as in last year’s survey, while Market developments (15%) falls from fourth to eighth year-on-year and Macroeconomic developments (11%) falls from eighth to 10th.

Source: Safety4sea