ICS Maritime Barometer Report: Political instability threatens maritime decarbonization

The International Chamber of Shipping (ICS) Maritime Barometer Report 2022-2023 reveals that uncertainty over fuel availability and infrastructure puts at risk ambitions to meet decarbonization targets, reinforcing the need for a clear plan of action to mitigate risk.

The inaugural ICS Maritime Barometer Report is the first full-scale annual survey of risk and confidence among maritime leaders. More than 130 C-suite decision makers, half of them shipowners and approximately 35% consisting of ship managers, have provided insight into the issues preoccupying them and how they are placed to manage their impact.

"Delays in government decision-making will have far reaching consequences for the shipping industry as key choices regarding supply chain resilience, greenhouse gas (GHG) reduction measures will determine how the industry evolves over the next decade", said Emanuele Grimaldi, Chairman of the International Chamber of Shipping

Key risk takeaways

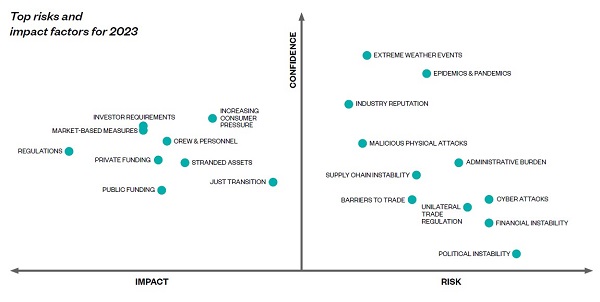

Risk posed by unilateral or fragmented regulation is growing but can be reduced if regulators pursue a long-term strategy to align with maritime’s global regulatory framework.

A shift towards greater protectionism may threaten maritime trade and mitigation requires government appreciation of the significance of seaborne trade for global prosperity.

Sustained pressure on supply chains in recent years means ship operators are increasingly comfortable with the need for continuing investments to deliver resilient service.

The perennial challenge of piracy combined with new war and cyber risks means that malicious threats to vessel safety remain a prime concern.

COVID-19 may be under control but lessons learned – particularly over seafarer welfare and essential trade – need to be permanently integrated into corporate and government policy.

"The report makes clear that political instability is a risk multiplier, threatening increased economic volatility and reducing growth as longstanding policies, trade arrangements and relationships are eroded", said Stuart Neil, Director of Strategy and Communications

Decarbonization

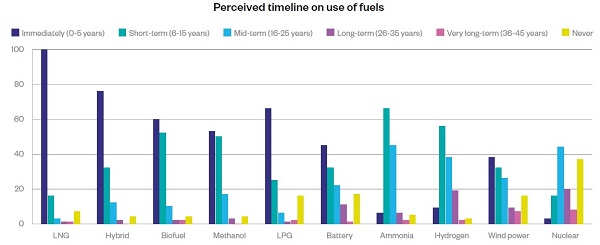

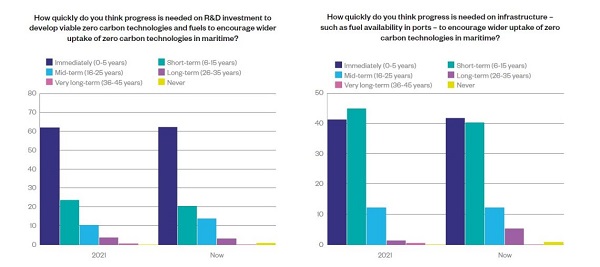

Respondents’ views on decarbonization factors highlight a maturing of the shipping industry’s understanding of the complex implications of the energy transition. While the practical implications of new greenhouse gas reduction regulations have continued to be the biggest concern for two years in a row, respondents demonstrated evolving opinions on the fuel landscape. This includes a shift in attitudes towards wind and nuclear power as potential, viable energy sources.

Key takeaways on decarbonization

- Availability of alternative fuels and supply infrastructure outweigh concerns about the status of ship technology as influencing factors in future investments.

- Nuclear power is anticipated sooner than some may imagine, with 9% of respondents projecting that nuclear commercial vessels will be viable within the next decade.

- Wind-assisted propulsion is growing in appeal, driven by the emergence of a wider range of demonstrable prototypes in operation from late 2022.

- Fossil ‘drag’ remains a factor in maritime, with several respondents expressing preference for LNG or heavy fuel oil over the coming decade.

- The digital dividends arising from COVID-19 continue to reap benefits as operators anticipate harnessing connectivity investments in their plans to improve energy

"Although our individual interests may vary, mutual understanding and collective action to leverage capabilities are the keys to a better future not just for our sector, but other sectors – and indeed, the world as a whole", added Emanuele Grimaldi, Chairman of the International Chamber of Shipping

Source: Safety4sea

| Read Here | |

|

|