Hapag-Lloyd reports lower box volumes amid Q1 revenue and profit decline

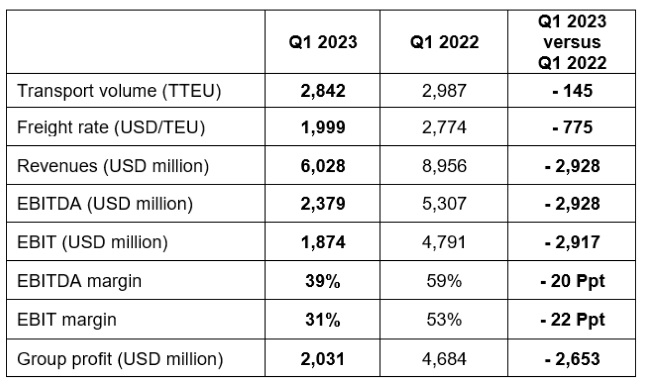

Hapag-Lloyd ended the first quarter of 2023 with container volumes 4.9% lower than in the first quarter of last year, at 2,842,000 TEUs.

According to the German company, this is the result of local destocking and weaker overall global demand.

In addition, the lower average freight rate of US$1,999/TEU was particularly responsible for the decline in revenue, which decreased to US$6 billion in the first three months of the year.

Meanwhile, transport expenses remained at the prior-year level of US$3.3 billion. "This will undoubtedly have an impact on our earnings over the course of the year, so we will be keeping a very close eye on our costs. In addition, we are pressing ahead on further developing our Group’s ‘Strategy 2030’, which will focus on quality and sustainability," said Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

| Read More: Hapag-Lloyd launches green biofuel-based transport solution |

Furthermore, earnings before interest, taxes, depreciation, and amortisation (EBITDA) of Hapag-Lloyd fell year-on-year to US$2.4 billion, earnings before interest and taxes (EBIT) decreased to US$1.9 billion and the company's profit more than halved to US$2 billion.

For the full year 2023, Hapag-Lloyd confirmed the forecast of 2 March, according to which EBITDA is expected to be in the range of US$4.3 - 6.5 billion and EBIT to be in the range of US$2.1 - 4.3 billion.

"However, the ongoing war in Ukraine, other geopolitical uncertainties and persistent inflationary pressures are creating risks that could negatively impact the forecast," noted the Hamburg-based ocean carrier.

Source: Container News

| Read Here | |

|

|