Offshore oil and gas investments to top $200bn by 2025

Offshore rigs, vessels, subsea and floating production storage and offloading (FPSO) activity are all set to flourish, according to a new analysis by Rystad Energy.

The offshore oil and gas sector is set for the highest growth in a decade in the next two years, with $214bn of new project investments lined up.

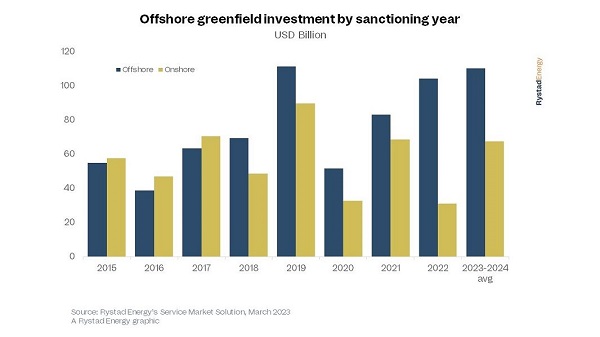

Rystad Energy research found that annual greenfield capex will break the $100bn mark in 2023 and in 2024 – the first breach for two straight years since 2012 and 2013.

Offshore activity is expected to account for 68% of all sanctioned conventional hydrocarbons in 2023 and 2024, up from 40% between 2015-2018. In terms of total project count, offshore developments will make up almost half of all sanctioned projects in the next two years, up from just 29% from 2015-2018.

| Read More: TotalEnergies expands its upstream portfolio in UAE with several offshore fields |

These new investments, led by the Middle East, will be a boon for the offshore services market, with supply chain spending to grow 16% in 2023 and 2024, a decade-high year-on-year increase of $21bn, Rystad Energy noted.

“Offshore oil and gas production isn’t going anywhere, and the sector matters now possibly more than ever. As one of the lower carbon-intensive methods of extracting hydrocarbons, offshore operators and service companies should expect a windfall in the coming years as global superpowers try to reduce their carbon footprint while advancing the energy transition,” said Audun Martinsen, head of supply chain research with Rystad Energy.

Source: Splash 247

| Read Here | |

|

|